The caption of this post is the headline from a new Virginian Pilot article that looks at the faltering residential real estate market and the fact that more and more homeowners are "underwater" on their properties. Here are a few highlights:

The caption of this post is the headline from a new Virginian Pilot article that looks at the faltering residential real estate market and the fact that more and more homeowners are "underwater" on their properties. Here are a few highlights:*

More than 33,000 homeowners in Hampton Roads owed more on their mortgages than their homes were worth at the end of 2008 as home prices continued to fall, according to a report released Wednesday by a mortgage research firm. That's roughly 13 percent of all mortgages in the local market, . . .

*

*

Across the country, more than 8.3 million homeowners owe more than their homes are worth, representing about 20 percent of all outstanding mortgages, First American CoreLogic reported. The majority of such "negative equity" mortgages are in states such as California, Florida, Texas and Michigan. In Virginia, 19.6 percent of all mortgages were underwater.

*

Brian Holland, president of Virginia Beach-based Atlantic Bay Mortgage Group, said many of the region's upside-down loans could be attributed to mortgages guaranteed by the Department of Veterans Affairs with no down payments. "Your typical VA buyer is going to fund 100 percent," said Holland, whose firm handles such loans from 19 mortgage offices in Virginia and the Carolinas. "After fees associated with the sale, they're automatically underwater."

*

"The ones who are really impacted by this are the ones who have to sell," she said. "Then you're forced in to a short-sell situation." A "short sale" means selling a house for less than the amount the seller owes the lender. Lenders agree to take a loss on the short sale to avoid the added costs of a foreclosure plus trying to maintain and resell the property.

*

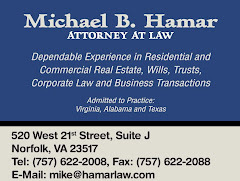

Negotiating a short sale is NOT an easy process and is something that neither most homeowners looking to sell or buyers looking to purchase have the where with all to undertake. Worse yet, many Realtors are rather clueless in how the process works as well. Michael B. Hamar, P.C., has experience in such transactions and can assist in expediting the process which can take weeks or months depending upon the lender involved and the particular circumstances.

*

In addition to the overview article on this blog, a detailed piece - with sample forms and exhibits - on negotiating a short sale is available upon request. It is not posted on this blog because of its length and numerous exhibits. Anyone interested in learning more should e-mail the office at mike@hamarlaw.com We also provide resources for for sale by owner ("FSBO") transactions which can save the seller the 6% real estate commission otherwise payable to a realtor. This savings can significantly improve the out of pocket loss for a homeowner who is "underwater" on their property.

.jpg)

.jpg)

No comments:

Post a Comment