In the current housing market and sub-prime mortgage shakeout, the number of properties going into foreclosure is going to increase and will provide opportunities to those with available funds and strong credit to purchase real bargains at foreclosure sales. To take advantage of this market opportunity, investors need to understand the mortgage process. Under Virginia law, both in-court and out-of-court foreclosures are possible. Generally, out-of court, also known as non-judicial foreclosures are the most prevalent. Typically, once initiated, a non-judicial foreclosure in Virginia takes less than two months. The majority of this article will focus on the non-judicial foreclosure process. Purchaser at foreclosure sales need to be familiar with the foreclosure process and some of the deadlines and hidden pitfalls that can trip up the unwary.

In the current housing market and sub-prime mortgage shakeout, the number of properties going into foreclosure is going to increase and will provide opportunities to those with available funds and strong credit to purchase real bargains at foreclosure sales. To take advantage of this market opportunity, investors need to understand the mortgage process. Under Virginia law, both in-court and out-of-court foreclosures are possible. Generally, out-of court, also known as non-judicial foreclosures are the most prevalent. Typically, once initiated, a non-judicial foreclosure in Virginia takes less than two months. The majority of this article will focus on the non-judicial foreclosure process. Purchaser at foreclosure sales need to be familiar with the foreclosure process and some of the deadlines and hidden pitfalls that can trip up the unwary.*

1. JUDICIAL FORECLOSURE: In Virginia, a deed of trust (in common parlance, a mortgage) may be foreclosed by filing a lawsuit known as a bill in equity. When and if necessary, a deed of trust could also be foreclosed through court action. In either case, a court order can be issued which specifies the terms and conditions of the sale, which are controlled by the deed of trust provisions. Special Commissioners are appointed by the Court to handle such sales and the ultimate deed to the foreclosure purchaser will be executed by the Special Commissioner. The court must confirm any such sale.

*

2. NON-JUDICIAL FORECLOSURE: Except for in unusual situations or where there is ongoing litigation between the mortgagor and mortgagee, non-judicial foreclosures are the typical means by which a deed of trust is foreclosed. Upon direction from the noteholder, the trustee under the deed of trust, or more commonly a substitute trustee specializing in foreclosure proceedings who has replaced the original trustee, will accelerate the note, give the necessary preliminary notices, and arrange the fore closure sale.

*

A. Preliminary Notices; Contents and Mailing Requirement: In general, the trustee/substitute trustee must give notice as provided in the deed of trust. In addition, Section 55-59.1, Code of Virginia of 1950, as amended, provides as follows concerning notices to be given by the trustee:

*

The trustee or the party secured shall give written notice of the time, date and place of any proposed sale in execution of a deed of trust, which notice shall include either (i) the instrument number or deed book and page numbers of the instrument of appointment filed pursuant to § 55-59, or (ii) said notice shall include a copy of the executed and notarized appointment of substitute trustee by personal delivery or by mail to:

*

(i) the present owner of the property to be sold at his last known address as such owner and address appear in the records of the party secured,

(ii) any subordinate lienholder who holds a note against the property secured by a deed of trust recorded at least 30 days prior to the proposed sale and whose address is recorded with the deed of trust,

(iii) any assignee of such a note secured by a deed of trust provided the assignment and address of assignee are likewise recorded at least 30 days prior to the proposed sale,

(iv) any condominium unit owners' association which has filed a lien pursuant to § 55-79.84,

(v) any property owners' association which has filed a lien pursuant to § 55-516, and

(vi) (vi) any proprietary lessees' association which has filed a lien pursuant to § 55-472.

*

Written notice shall be given pursuant to clauses (iv), (v) and (vi), only if the lien is recorded at least 30 days prior to the proposed sale.

*

Mailing of a copy of the advertisement or a notice containing the same information to the owner by certified or registered mail no less than 14 days prior to such sale and to lienholders, the property owners' association or proprietary lessees' association, their assigns and the condominium unit owners' association, at the address noted in the memorandum of lien, by ordinary mail no less than 14 days prior to such sale shall be a sufficient compliance with the requirement of notice.

*

The written notice of proposed sale when given as provided herein shall be deemed an effective exercise of any right of acceleration contained in such deed of trust or otherwise possessed by the party secured relative to the indebtedness secured. (Emphasis added)

*

Obviously, in order to give proper notice, the trustee will need to have a title examination performed to confirm what, if any subordinate lienholders must be notified of the sale. The notice must also give the name of the trustee and the address and phone number of a person who will be able to respond to inquiries about the foreclosure sale. A sample notice (as well as a sample Notice to be advertised) is attached hereto as Exhibit A.

*

B. Advertisement of Sale: Generally deeds of trust will specify the number of times that notice of the sale must be published prior to the foreclosure sale. To be safe, a trustee should review the advertisement provisions of the deed of trust and consult Section 55-59.2, Code of Virginia of 1950, as amended, which sets out the statutory advertisement requirements:

§ 55-59.2. Advertisement required before sale by trustee. A. Advertisement of sale by a trustee or trustees in execution of a deed of trust shall be in a newspaper having a general circulation in the city or county wherein the property to be sold, or any portion thereof, lies pursuant to the following provisions:

1. If the deed of trust itself provides for the number of publications of such newspaper advertisement, which may be done by using the words "advertisement required" or words of like purport followed by the number agreed upon, then no other or different advertisement shall be necessary, provided that, if such advertisement be inserted on a weekly basis it shall be published not less than once a week for two weeks and if such advertisement be inserted on a daily basis it shall be published not less than once a day for three days, which may be consecutive days, and in either case shall be subject to the provisions of § 55-63 in the same manner as if the method were set forth in the deed of trust. Should the deed of trust provide for advertising on other than a weekly or daily basis either of the foregoing provisions shall be complied with in addition to those provided in such deed of trust. Notwithstanding the provisions of the deed of trust, the sale shall be held on any day following the day of the last advertisement which is no earlier than eight days following the first advertisement nor more than thirty days following the last advertisement.

2. If the deed of trust does not provide for the number of publications of such newspaper advertisement, the trustee shall advertise once a week for four successive weeks; provided, however, that if the property or some portion thereof is located in a city or in a county immediately contiguous to a city, publication of the advertisement five different days, which may be consecutive days, shall be deemed adequate. The sale shall be held on any day following the day of the last advertisement which is no earlier than eight days following the first advertisement nor more than thirty days following the last advertisement.

B. Such advertisement shall be placed in that section of the newspaper where legal notices appear or where the type of property being sold is generally advertised for sale.

C. Sale Procedures:

1. Time of Sale. The sale must be made no earlier than eight days after the first ad and no more than 30 days after the last advertisement.

2. Special Procedures. Written one-price bids may be made and received by the trustee for entry by announcement at the foreclosure sale. Any bidder who attends the foreclosure may inspect the written bids.

3. Manner of Sale. The sale is to be made at auction to the highest bidder. Unless otherwise required by the deed of trust, the trustee may require a bidder to make a 10 percent nonrefundable cash deposit. The trustee must apply the proceeds of the sale first to expenses of the sale, including a 5 percent trustee's commission, second to unpaid taxes, assessments and levies, third to liens in order of their priority and the balance, if any, to the borrower. At the sale, a Memorandum of sale will be executed by the trustee and the successful high bidder confirming the sales price and closing deadline.

4. Deadline for Closing of Sale. Generally, the notice of sale will specify how soon after the public auction the highest bidder must complete the sale. Ten or fifteen days are fairly typical deadlines for closing. The trustee will execute and deliver a deed to the buyer.

5. Deficiency. If the sales proceeds are insufficient to satisfy the amounts incurred for the costs of sale and all unpaid principal and interest due under the note, a lender may pursue a borrower for a deficiency judgment in Virginia. No limits are imposed.

6. Redemption. In a court-ordered foreclosure sale the court may give the borrower a redemption period. Otherwise, contrary to popular misconception, Virginia does not give borrowers any redemption rights.

7. Trustee Accounting. Under Section 26-15, Code of Virginia of 1950, as amended, the trustee under the foreclosed deed of trust must provide the commissioner of accounts for the jurisdiction where the property is located within six (6) months of the date of the public auction. This accounting will set out how the sales proceeds were applied. The accounting for a foreclosure will contain a number of materials: (a) the original note; (b) complete copy of the recorded deed of trust and any substitution of trustee filed by the noteholder; (c) an original affidavit of publication for the advertisement; (d) proof of giving of the notice required under Section 55-59.1 of the Virginia Code; (e) copy of written high bid, if written bids were accepted prior to the sale; (f) receipt from the City Treasurer for real estate taxes paid from the sale proceeds; (g) documentation of any attorneys fees paid; (h) copy of the recorded trustee’s deed; (i) documentation of disbursements made from the sale proceeds; and (j) a statement from the noteholder of the total amount due on the date of the sale.

3. INVESTOR PITFALLS TO AVOID: As initially noted, purchasing a property at foreclosure can be a means of securing a true bargain well below the true market value of the property. However, there are certain inherent dangers that need to be minimized by the prudent investor/purchaser to the extent possible. Some of these risks are as follows:

A. Lack of Inspection. The first risk is that typically, any would be purchaser/investor may not have any opportunity to conduct an inspection of the property prior to the foreclosure sale. The sale and conveyance by the trustee will provide that the property is sold “AS IS.” Thus, if the property has any significant defects, the purchaser will have no recourse back against the trustee under the deed of trust. What you see is what you get.

*

B. Superior Liens and Title Issues. The deed delivered to the successful purchaser will be a Special Warranty Deed, which means that the trustee makes NO WARRANTY OF TITLE except that the trustee has not encumbered title to the property. This means that (1) if the deed of trust foreclosed is a second deed of trust, the purchaser takes title subject to the first deed of trust which may be accelerated under the due on sale provisions therein upon the transfer of title out of the borrowers under the foreclosed deed of trust. Therefore, it is critical that the purchaser have a plan in place to deal with paying off the first deed of trust should it subsequently be accelerated. It will do no good to find a bargain only to lose it to foreclosure.

*

Another problem that frequently arises is that there can be title defects that predate the deed of trust being foreclosed. While the trustee has generally obtained a current owner title examination to determine what subordinate lienholders, if any, should receive the required notice of foreclosure, this title exam does NOT identify prior title issues – e.g., prior unreleased deeds of trust; tax liens; old judgment liens and other potential title problems. Therefore, it is important that the investor/purchaser who is seriously considering buying property at a foreclosure sale obtain a full title examination of the property. This will identify issues that will need to be addressed and avoid unexpected title issues not cured by the foreclosure of the deed of trust.

*

C. Hazard Insurance. The typical foreclosure memorandum of sale provides that all risk of lost passes to the purchaser from the time the memorandum is signed on the court house steps. Therefore, it is critical that the successful bidder have everything in place to have insurance effective immediately. If the property is damaged by fire or casualty between the date of sale and closing, the loss will be on the purchaser.

*

D. Closing Deadlines. As indicated, the advertisement of the sale and the memorandum executed by the successful bidder will provide that closing must occur within a short period of time – usually 10 to 15 days from the auction date. If the successful bidder fails to close, the nonrefundable deposit will be lost. While, trustees will sometimes grant and extension of the closing deadline, there is NO guaranty that such will be the case. Therefore, prior to bidding at the sale, unless an investor has significant amounts of cash or available lines of credit, the investor MUST have a plan in place to secure the needed closing funds before bidding at the sale. High bidders who fail to close on schedule can and do lose deposits on a regular basis. This type of loss can be avoided by proper advanced planning.

*

EXHIBIT A

Notice of Foreclosure

*

VIA CERTIFIED ANDFIRST CLASS MAIL

____________________

____________________

Re: Deed of Trust dated ________, recorded as Instrument No. ___________ in the Clerk’s Office of the Circuit Court of the City of Norfolk, Virginia Securing Note dated _____________

Dear _________________:

Please be advised that __________________________ (the “Lender”), has requested the undersigned Trustee to advertise for sale at public auction the property located at __________________________, Norfolk, Virginia ____________, Tax ID No. _____________ (the (“Property”), which is subject to the Deed of Trust dated ________________, and recorded as Instrument No. ___________________ in the Clerk’s Office of the Circuit Court of the City of Norfolk, Virginia (the “Deed of Trust”), securing that certain Note dated ____________, in the principal sum of $____________________, together with interest thereon at a rate of ______% per annum.

The Note requires consecutive monthly payments of $___________ each, commencing on _____________, and every month thereafter until ___________, at which time the entire unpaid principal amount of the Note, together with all accrued and unpaid interest thereon is due and payable in full. Contrary to the requirements of the Note, you have not paid the required monthly payments and the Note is in default.

As a result of such default, the Lender has requested us to advise you that unless the entire unpaid balance of the Note, including accrued and unpaid interest thereon, is immediately received, then on _______________, at _______ A.M., the Property will be sold at public auction at that time to the highest bidder. A copy of the advertisement that will appear in ________________ commencing ___________, is enclosed.

The Lender advises that the unpaid balance now due and owing under the Note is $________________, exclusive of expense incurred up through the date of sale, including but not limited to additional interest, late charges, newspaper advertisements, attorney’s fees and trustee’s fees, which sums will be itemized to you upon inquiry. Please call me at 622-2008 for complete pay off information in order to prevent foreclosure.

Very truly yours,

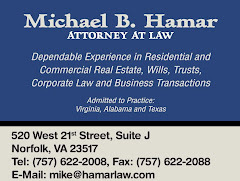

Michael B. Hamar

EXHIBIT A

Notice of Foreclosure

*

VIA CERTIFIED ANDFIRST CLASS MAIL

____________________

____________________

Re: Deed of Trust dated ________, recorded as Instrument No. ___________ in the Clerk’s Office of the Circuit Court of the City of Norfolk, Virginia Securing Note dated _____________

Dear _________________:

Please be advised that __________________________ (the “Lender”), has requested the undersigned Trustee to advertise for sale at public auction the property located at __________________________, Norfolk, Virginia ____________, Tax ID No. _____________ (the (“Property”), which is subject to the Deed of Trust dated ________________, and recorded as Instrument No. ___________________ in the Clerk’s Office of the Circuit Court of the City of Norfolk, Virginia (the “Deed of Trust”), securing that certain Note dated ____________, in the principal sum of $____________________, together with interest thereon at a rate of ______% per annum.

The Note requires consecutive monthly payments of $___________ each, commencing on _____________, and every month thereafter until ___________, at which time the entire unpaid principal amount of the Note, together with all accrued and unpaid interest thereon is due and payable in full. Contrary to the requirements of the Note, you have not paid the required monthly payments and the Note is in default.

As a result of such default, the Lender has requested us to advise you that unless the entire unpaid balance of the Note, including accrued and unpaid interest thereon, is immediately received, then on _______________, at _______ A.M., the Property will be sold at public auction at that time to the highest bidder. A copy of the advertisement that will appear in ________________ commencing ___________, is enclosed.

The Lender advises that the unpaid balance now due and owing under the Note is $________________, exclusive of expense incurred up through the date of sale, including but not limited to additional interest, late charges, newspaper advertisements, attorney’s fees and trustee’s fees, which sums will be itemized to you upon inquiry. Please call me at 622-2008 for complete pay off information in order to prevent foreclosure.

Very truly yours,

Michael B. Hamar

*

*

*

*

NOTICE OF TRUSTEE SALE OF

______________________

Norfolk, Virginia _______

Tax ID No. ___________

In execution of a Deed of Trust, dated _________________, and recorded as Instrument No. _________________ in the Clerk’s Office of the Circuit Court of the City of Norfolk, Virginia, in the original principal amount of $_____________, and default having occurred, the undersigned having been duly appointed as Trustee and having been directed by the noteholder to foreclose under said Deed of Trust, will offer the below described property for sale at public auction to the highest bidder, for cash, _________________, at ________A.M., on the front steps of the Circuit Court of the City of Norfolk, Virginia, 23510. The aforesaid property being described as follows:

ALL THAT certain lot, piece or parcel of land, with the buildings and improvements thereon and the appurtenances thereto belonging, situate in the City of Norfolk, Virginia, and known, numbered and described as Lot _____ in Block number _____ as shown on that plat entitled “Subdivision of ________________________,” which Plat is recorded in the Clerk’s Office of the Circuit Court of the City of Norfolk, Virginia, in Map Book ___ at page ___.

MICHAEL B. HAMAR, TRUSTEE

MICHAEL B. HAMAR, P.C.

520 W. 21st Street, Suite J

Norfolk, Virginia 23517

(757) 622-2008

TERMS: CASH: The successful bidder will be required to deposit $_________ at the sale

by cashier’s check and settlement held within ten (10) days.

To be published in _____________ on ___________, __________, and __________, 200___.

*

*

*

NOTICE OF TRUSTEE SALE OF

______________________

Norfolk, Virginia _______

Tax ID No. ___________

In execution of a Deed of Trust, dated _________________, and recorded as Instrument No. _________________ in the Clerk’s Office of the Circuit Court of the City of Norfolk, Virginia, in the original principal amount of $_____________, and default having occurred, the undersigned having been duly appointed as Trustee and having been directed by the noteholder to foreclose under said Deed of Trust, will offer the below described property for sale at public auction to the highest bidder, for cash, _________________, at ________A.M., on the front steps of the Circuit Court of the City of Norfolk, Virginia, 23510. The aforesaid property being described as follows:

ALL THAT certain lot, piece or parcel of land, with the buildings and improvements thereon and the appurtenances thereto belonging, situate in the City of Norfolk, Virginia, and known, numbered and described as Lot _____ in Block number _____ as shown on that plat entitled “Subdivision of ________________________,” which Plat is recorded in the Clerk’s Office of the Circuit Court of the City of Norfolk, Virginia, in Map Book ___ at page ___.

MICHAEL B. HAMAR, TRUSTEE

MICHAEL B. HAMAR, P.C.

520 W. 21st Street, Suite J

Norfolk, Virginia 23517

(757) 622-2008

TERMS: CASH: The successful bidder will be required to deposit $_________ at the sale

by cashier’s check and settlement held within ten (10) days.

To be published in _____________ on ___________, __________, and __________, 200___.

.jpg)

.jpg)

No comments:

Post a Comment